Agentic AI Underwriting

Underwriting Challenges

Data complexity creates huge backlogs

Expansive internal and external data sources makes decision-making complex. Our industry-specific knowledge graphs use semantic context to unify these insights, embedding them directly into your workflows.

Lack of Underwriting prioritization prevents focusing on the right risks

Overwhelmed by high application volumes, underwriting teams struggle to prioritize the best-fit risks; missing opportunities to maximize yield on their investment.

Misclassification is common and drives underwriting loss

Understanding clients is complex. Misclassification can be costly and even catastrophic, leading to inaccurate risk assessment, pricing, exposure, and exclusions.

Personnel turnover risks intellectual capital

Employee turnover and retirement put critical underwriting expertise at risk. Due to this, best practices are difficult to capture and even harder to scale.

Product updates take quarters to implement

To stay competitive and compliant, companies must update products often; but system complexity, technical debt, and tight IT budgets slow even the smallest initiatives

No visibility on audit or compliance of underwriting decision

Underwriting decisions depend heavily on individual judgment. Compliance issues are often uncovered much later, which can pose costly risks to your business.

Solution & Benefit

Submission Ingestion

Solutions

- Accurate & complete ingestion of all documents related to submissions, including the ingestion of updates, corrections, and emails.

- Automated data quality management & cross-referencing responses with internal and external sources to identify and resolve discrepancies with human-in-the-loop review and validation.

- Expert-developed knowledge graphs capture critical industry and LOB-specific information needed for downstream underwriting decisions.

Benefits

- Dramatic increase in the accuracy and availability of data for use in underwriting decisions.

- Reduction in administrative work outsourced to BPO or performed by Underwriting Operations, Assistants, and Underwriters, supporting increased focus on risk analysis.

- Improvement in broker response time, time to quote, and ultimately increased conversion rates.

Business Classification

Solutions

- weav.ai accurately classifies businesses to the appropriate industry and class codes by evaluating insured operations and internal and external data sources.

- Classification leverages the full breadth of documents available across lines of business to ensure accurate recommendations.

-Support for underwriter review includes rationale and evaluation of alternative classes.

Benefits

- Accurate underwriting decisions and risk pricing require accurate classification

- Accuracy increases drive improvements in loss ratio, market competitiveness and reserving.

- Class code accuracy supports more personalized underwriting treatment

Clearance

Solutions

- weav.ai extracts appointed broker and insured entity information from submission documents and emails.

- weav.ai easily integrates with existing clearance systems or can provide clearance support.

- AI methods help identify similar entities and ensure accurate clearance decisions.

Benefits

- Rapid automated response improves broker service and minimize human intervention.

- Increased accuracy reduces downstream account ownership disputes and strengthens broker relationships.

- Underwriting Operations, Assistants and Underwriters can focus on more productive core underwriting activities.

Appetite

Solutions

- Appetite scorecards built on industry and line business-specific models and easily align to existing appetite communications.

- Scorecards evaluate submissions on multiple levels (from account down to insured object (building or vehicle).

- Scorecards are maintained by business users and can be updated without code.

Benefits

- Fine-grain appetite control focuses your underwriting capacity on the risks that truly matter.

- No-code updates allow rapid market response

Fast communications with agents reinforces appetite preferences (and aligns future submissions).

Triage

Solutions

- Prioritize new business and renewals with a powerful framework supporting industry and LOB requirements.

- Leverage weav.ai’s expert-designed triage library to help build your scorecards.

- Analyze the entire submission, including narrative content, with no-code AI-driven scorecards.

Benefits

- Industry differentiated analysis and fine-grained support let you prioritize the risks that meet your underwriting portfolio goals.

- No-code scorecard design supports continuous improvement and rapid market response.

- Triage insights help underwriters understand why a risk was prioritized and potential opportunities.

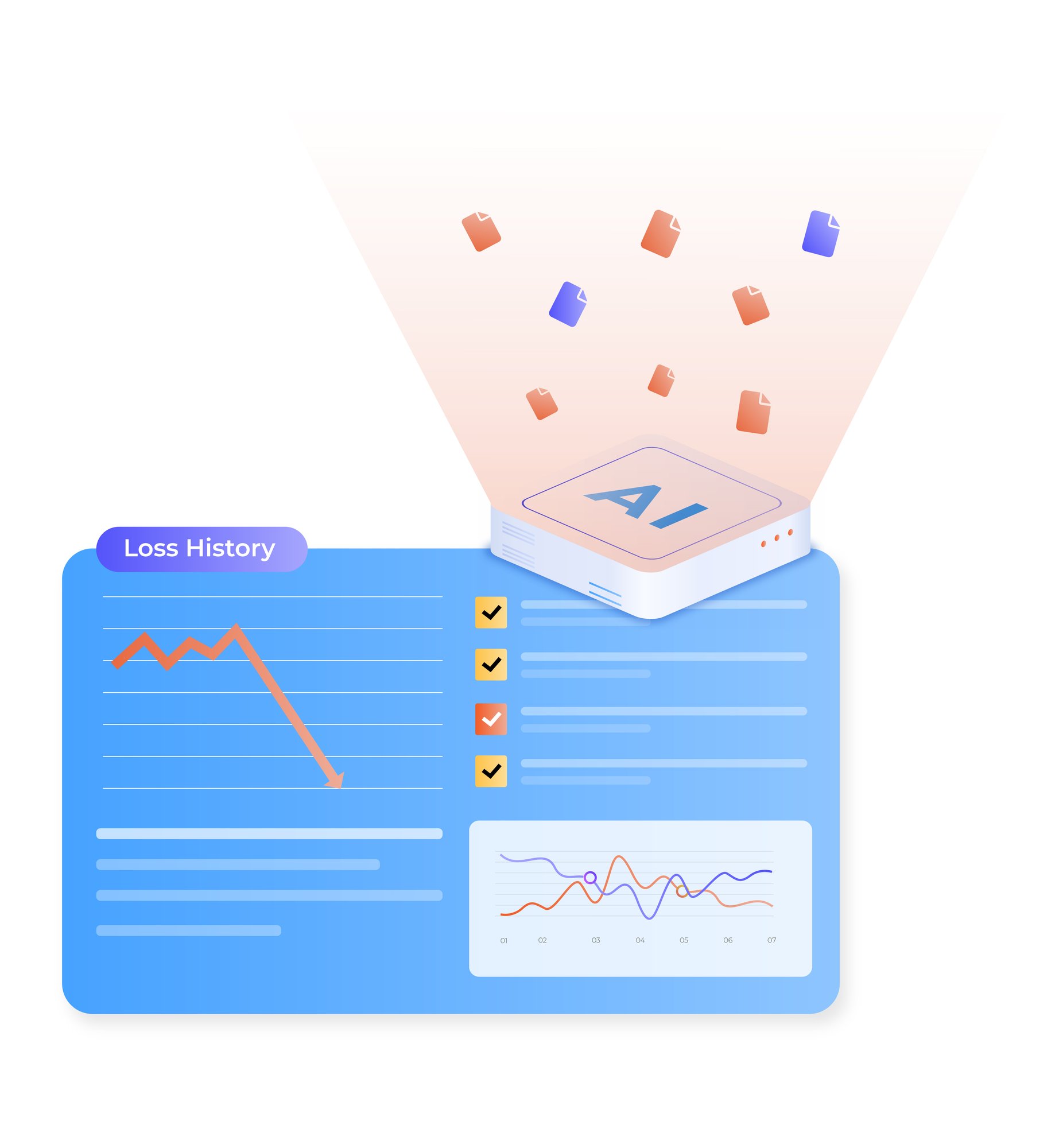

Loss Analysis

Solutions

- Easily ingest, organize, and structure loss histories in any format into standardized views suitable for underwriting analysis.

- Visualize losses to surface trends by time, location, and line of business.

- Analyze losses with advanced loss scorecards designed for each industry and LOB.

Benefits

- Significant reduction in cycle time and data quality improvement.

- Consistent analysis of losses to identify trends and apply SME developed best practices.

- Find industry and LOB-specific loss insights to improve your risk assessment.

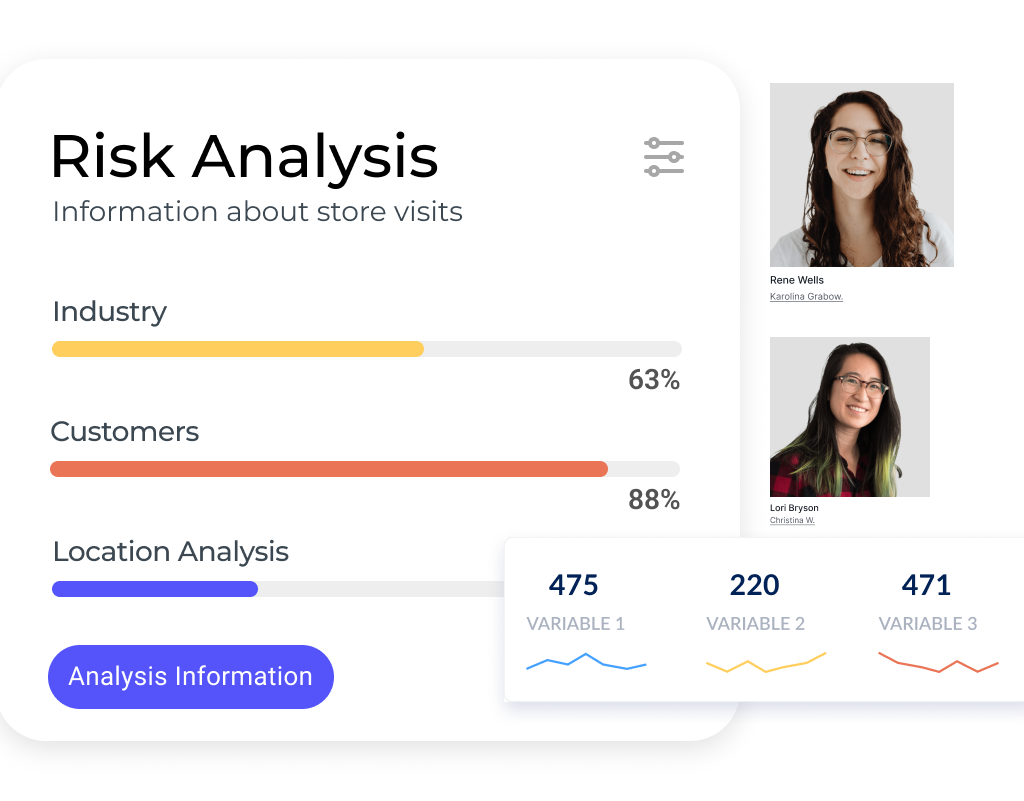

Risk Analysis

Solutions

- In a single view, visualize exposure and loss analysis to obtain a comprehensive risk understanding.

- Risk insights tailored to each line of business and industry help underwriters evaluate high-impact considerations.

- Add your company’s proprietary insights, third-party data or model recommendations to analyze risks in one place.

Benefits

- Best practice-based insights help your entire team leverage risk insights previously only available to your most senior team members.

- Enhance risk understanding with industry and product-specific insights.

- Better insights lead to better underwriting decisions and improved loss ratios.

Underwriting Recommendation

Solutions

- Underwriting scorecards create a decision-making framework to expertly handle simple and complex underwriting decisions.

- Recommendations are fully explained with high-level summaries and explanations of line item scores.

- Leverage weav.ai’s growing library of professionally developed underwriting scorecards for multiple industries and LOBs.

Benefits

- Consistent underwriting analysis drives consistent high-quality underwriting results.

- Transparent underwriting explanations help underwriters communicate risk assessments with brokers and insureds.

Expert-developed scorecards accelerate new product deployment.

Underwriting Compliance

Solutions

- weav.ai provides a complete audit trail of the underwriting decision process with full documentation and explanation of underwriting recommendations and risk insight analysis.

- All data ingested and data quality corrections are documented with full traceability to original source documents.

- weav.ai provides a neutral, unbiased evaluation of underwriting compliance of each submission based on carrier underwriting guidelines.

- weav.ai can audit previously underwritten accounts to evaluate compliance with underwriting guidelines.

- weav.ai can also audit underwriting for distribution partners, such as MGAs.

Benefits

- Consistent, well-documented decisions support regulatory compliance requirements.

- Full traceability of data sources and corrections ensures carriers, regulators, and underwriters have a complete understanding of underwriting and any changes made.

- Evaluation of underwriting guideline compliance ensures consistent underwriting standards and supports risk portfolio assumptions.

- The ability to audit internal and business partner underwriting decisions ensures consistent underwriting standards and compliance with MGA distribution agreements.